Hey, it’s Steve from Feasible Creative — your weekly shortcut to smarter money moves.

BUDGETING

Reflection Time

Another year is almost over. Whether you’re crushing your money goals or stuck in a rut, these three year-end exercises will set you up for success in the new year.

Here’s exactly what I do every December, and the tools that make it a breeze.

Need help building a personalized budget (for free)? ➡️ Book a 1:1 Budget Review Call

The Checklist

Net Worth Snapshot: Pull up your net worth from January 1st and compare it to today. This single number often tells you more about your financial progress than any budget category does.

Are you where you expected? What can you change next year to reach your target?

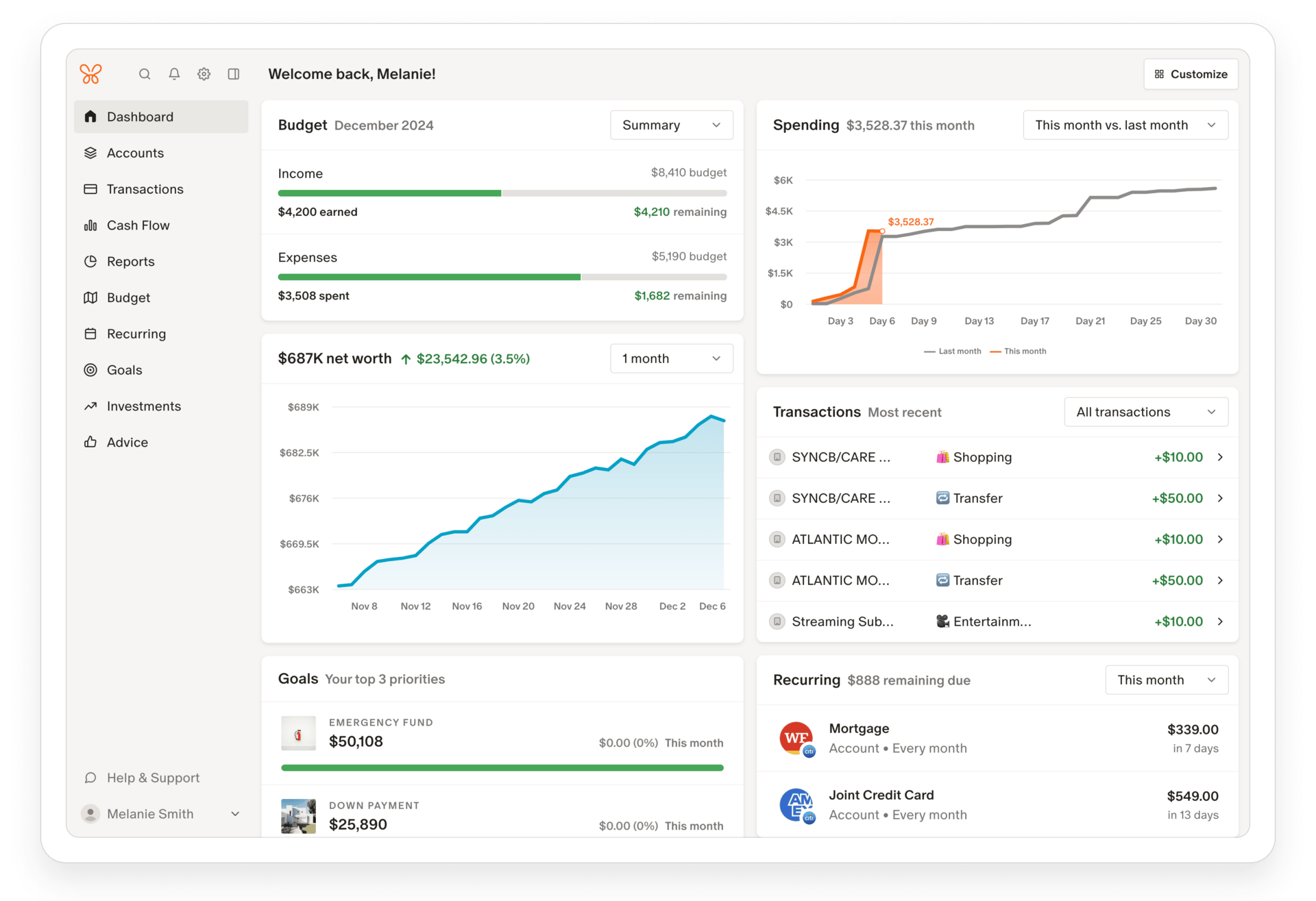

The problem is, tracking net worth gets messy once you have more complicated financials. That’s why I use the free Personal Dashboard from Empower. This tool pulls everything into one place and automatically calculates your net worth for you.

Saving/Spending Goal Check: You probably have some bigger financial goals that have been top of mind all year (for example, paying down student debt, saving for a house, or building an emergency fund).

Now’s the time to see how things are actually going. The simplest way to do so, is with a budget app like Monarch. If you want to see for yourself, Click here and use code MONARCHVIP to get 50% off your first year (plus a 7-day free trial).

Monarch offers a goal tracking section to see how far you’ve come. This year I’ll be checking to see how my house down payment savings are coming along.

Recalibrate Your Budget: This is where people find the biggest surprises. Compare what you planned to spend versus what you actually spent in each category.

Ideally, you’re doing this more frequently, but a full year of data is even more helpful. Again, Monarch helps with this or you can stick with a spreadsheet.

💡 My Take

You don’t have to wait until January 1st to do any of this. In fact, reviewing now means you start the new year ready to go. This journey isn’t about perfection, it’s about knowing where you stand and making adjustments as needed.

What do you do at year-end to review your finances? Hit reply and let me know!

Ask: Forward this newsletter to someone who could use the help!

New here? Subscribe to get future newsletters.

Talk Soon,

Steve

What did you think about today's newsletter?

RESOURCES

Creative Fuel

YOUTUBE

In Case You Missed It

“Start where you are. Use what you have. Do what you can.” - Arthur Ashe

Disclaimer: The content provided in this newsletter is for informational and educational purposes only. It is not intended to be a substitute for professional financial advice. Please consult with a financial advisor before making any financial decisions. This newsletter may contain affiliate links, which means I may earn a commission if you make a purchase through these links, at no extra cost to you.

Empower Personal Wealth, LLC (“EPW”) compensates Feasible Creative LLC for new leads. Feasible Creative LLC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.