MOTIVATION

Start Getting Serious

Hey all, Steve here.

This year is flying by. New Year’s felt like yesterday – now the year is almost halfway over.

Let this be a reminder: without clear financial goals, time — and your chance to make real progress, slips away.

These goals aren’t just nice to have, they’re 100% necessary. Let’s learn why:

Think BIG!

Imagine you want to get better at golf. You watch a few videos, hit the driving range, but without a clear goal, you still end up shooting over 100 by the end of summer.

(this isn’t anecdotal, I promise…).

Money works the same way. Without a specific target and consistent tracking, it’s virtually impossible to tell if you’re even making progress at all.

The good news is there’s still plenty of time to make an impact. Here are a few realistic financial goals you can set today:

Example Goals

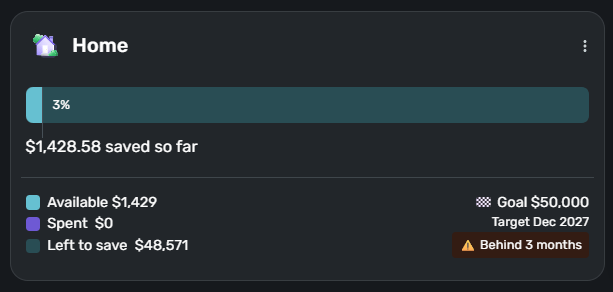

Save More: Don’t just aim to “save more”. Set a monthly target of $1,000 for example, and actually track how things are going.

Pro Tip: You can do this easily with my favorite budget app, Quicken Simplifi which has a limited time offer: Get 50% off.

Quicken Simplifi’s Savings Goals feature

Make More: Want to earn an extra $10,000 this year? Start tracking your side hustle income each month and build a plan to hit that number.

These are just two simple examples, but notice how each one includes a clearly defined target.

What are your goals for this year? Hit reply and let me know!

CREDIT CARDS

Credit Card Reviews

Check out my reviews of some top credit card options available today. When used responsibly, these can be a great addition to your financial toolkit.

RESOURCES

Creative Fuel

🎵 Music: mike. (formerly known as Mike Stud) dropped a mellow, introspective track called “reasons why”. It’s been on repeat for me lately.

🎞️ Video: Gary Vee recently sat down with the Money Buys Happiness podcast for 45 minutes of raw, uncut business & life advice.

YOUTUBE

In Case You Missed It

New to budgeting? Check out my blueprint to get started (for free). It’s easier than you think:

Keep Saving,

Steve | Feasible Creative

“You are never too old to set another goal or to dream a new dream.” - Unknown

Disclaimer: The content provided in this newsletter is for informational and educational purposes only. It is not intended to be a substitute for professional financial advice. Please consult with a financial advisor before making any financial decisions. This newsletter may contain affiliate links, which means I may earn a commission if you make a purchase through these links, at no extra cost to you.