BUDGETING

Stand Out, When Others Stress Out

Hey, it’s Steve.

Feeling anxious about the economy? You’re not alone.

Here’s the thing: while everyone else panics, you can find peace of mind with proper budgeting.

This assumes you do one thing:

Avoid falling for common misconceptions.

With that, here are 3 mindsets to avoid:

What Most People Get Wrong

If you go over budget, you’ve failed: While sticking to your plan is important – life will always throw curveballs. Unexpected expenses like car repairs or parking tickets are bound to happen.

These occasional deviations are normal.

The real issues occur if you’re consistently missing your saving and spending goals.

Solution: Build an emergency fund (covering at least 3 - 6 months of your living expenses). This safety net will help you feel more prepared to navigate future challenges.

Budgeting Takes Too Long: Modern apps allow you to build a budget in under 5 minutes with minimal weekly maintenance.

My go-to right now is Quicken Simplifi. Click here to get 50% off (for a limited time only) – that’s $3 per month.

If you need to keep an even closer eye on every dollar — try YNAB: Click here for a 34-day free trial.

Now some readers may think, ‘Paying for a budgeting app is counterintuitive.’ While there’s some truth to that, I encourage you to keep reading:

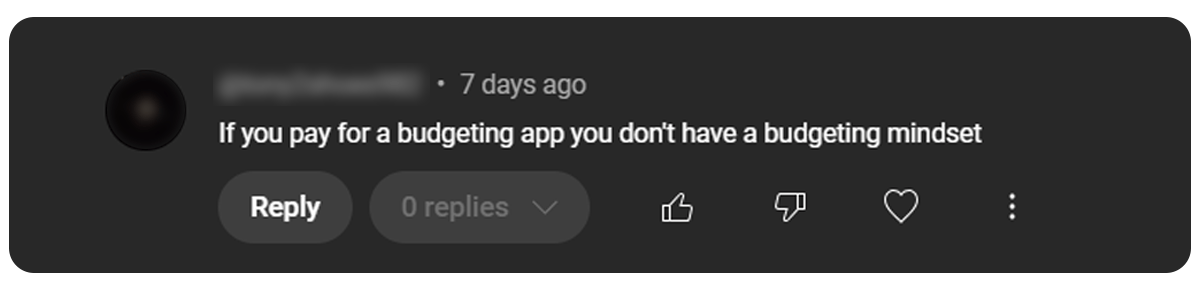

Paying For Apps is a Waste of Money: I saw this comment on one of my recent YouTube videos:

Honestly, I get it. The whole point of budgeting is to save money, so why would you spend money to do it?

Here’s the reality: the ROI on budgeting apps can be HUGE.

Said another way, most users get far more value from these tools versus what they pay.

Sure, you could build a spreadsheet for free (and as someone who loves spreadsheets, I’m in favor of this). But these are time-consuming, require manual updates, and leave room for human error.

On the other hand, a good budgeting app automates the process and gives you more time to live, instead of mindlessly tracking spend.

YouTube

In Case You Missed It

As mentioned, I’m a big fan of Quicken Simplifi – here’s everything you need to know before signing up:

Keep Saving,

Steve | Feasible Creative

“Why fit in when you were born to stand out?” - Dr. Seuss

Disclaimer: The content provided in this newsletter is for informational and educational purposes only. It is not intended to be a substitute for professional financial advice. Please consult with a financial advisor before making any financial decisions.

This newsletter may contain affiliate links, which means I may earn a commission if you make a purchase through these links, at no extra cost to you. Thank you for supporting me!